Graphics Show Nose-Dive In Hotel Room Tax Revenues For Raiders Stadium During COVID-19 Pandemic

By Alan Snel of LVSportsBiz.com

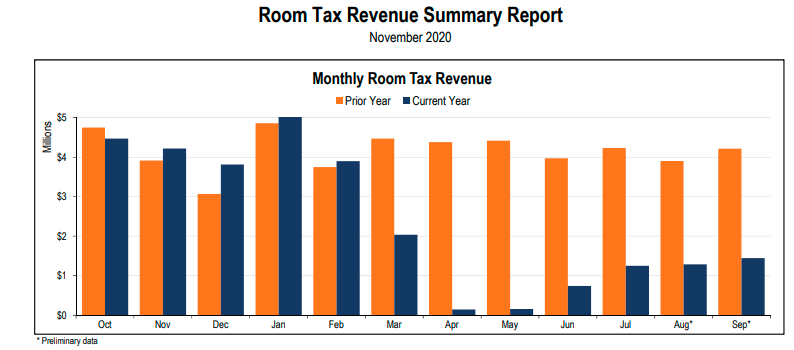

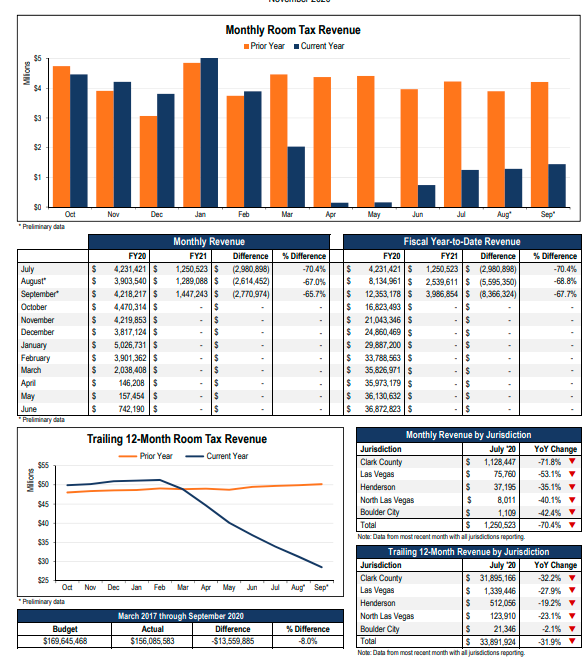

If you’re collecting hotel room tax money to help pay for a new NFL stadium in Clark County, the revenue bar chart numbers are brutal because of the 2020 COVID-19 pandemic.

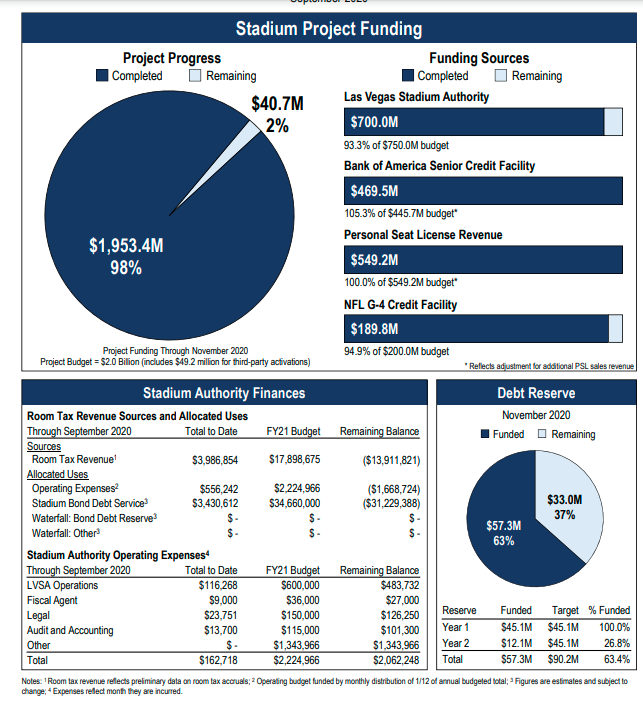

Take a look at the 2019 vs. 2020 bar chart graphics showing hotel room tax revenues being collected to help pay for the Raiders’ $2 billion stadium project on the west side of I-15 across from Mandalay Bay hotel-casino. Clark County had to tap the stadium tax reserve fund for $11.5 million so that the county could make a $16 million payment on the stadium bonds Dec. 1.

The novel coronavirus prompted Gov. Steve Sisolak to close the Strip and hotel-casinos in Nevada in April and May and hotel room tax revenues for the Raiders’ stadium are still down 65-70 percent, according to the revenue charts for Wednesday’s Las Vegas stadium board meeting.

From March 2017 through September 2020, the stadium authority had budgeted nearly $170 million in room tax revenue. But the nose dive in tax revenues that began in March because of the COVID-19 pandemic dropped the actual room tax revenues to $156 million — a drop of $13.5 million, or 8 percent.

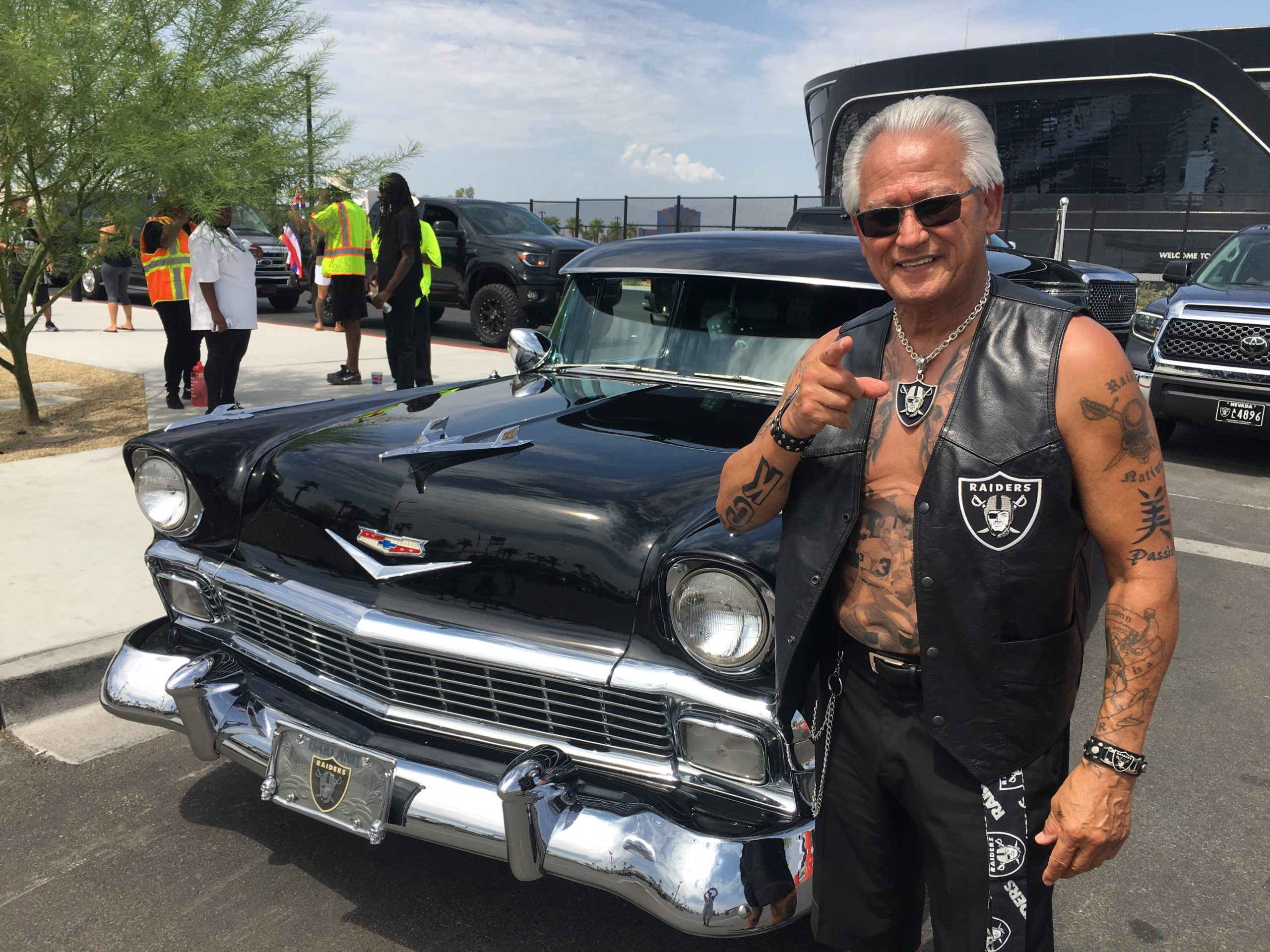

The public is contributing $700 million to construction of the 65,000-seat, domed stadium, while the Raiders took out a $469.5 million Bank of America loan, scored big with personal seat license revenue to the tune of $549.2 million and used an NFL loan of $89.8 million for the project.

The stadium board video conference meeting is 1 p.m. Wednesday.