Streaming Service DAZN Scored First With Soccer, Now With Boxing, MMA; Becomes Player Along With ESPN+

By Cassandra Cousineau

LVSportsBiz.com

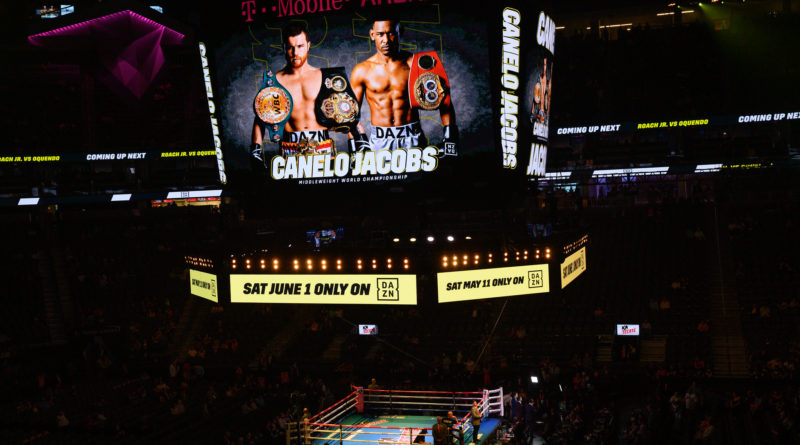

The thousands of boxing fans who descended on T-Mobile Arena earlier this month for the Canelo Alvarez-Daniel Jacobs fight in Las Vegas saw a sports streaming service being promoted on the plaza outside the arena and on the center-hung Jumbotron scoreboard.

The first thing you wonder about streaming service DAZN is how do you pronounce it? For the record, it’s pronounced, “Da Zone.” Let’s try that again with purpose: “DA ZONE!”

It’s a name so confusing, the company hired famed announcer Michael Buffer, known for his iconic, “Let’s get ready to rumble” catch phrase, to head up a marketing campaign during its U.S. roll out. Fortunately, the business model of the sports streaming service isn’t as complicated as pronouncing the name.

The model appeals to the cord-cutting-under-40 generation because no cable plan or satellite service is required. You pay $19.99 a month — or $99 a year — download an app and stream sports on your phone, tablet, or smart T.V. The cost puts the company in direct competition with ESPN+ which at $4.99 a month, charges substantially less. ESPN+ has a deal with Las Vegas-based UFC.

DAZN is operating on the philosophy of more — more content, more events, and lots more money. Three years ago, the service launched in Austria, Germany, Japan and Switzerland primarily focused on England’s Premier League and Spain’s La Liga. Today, it offers over 20,000 events and holds streaming rights to the NFL, NBA and NHL, Cricket, field hockey, gymnastics, rugby and tennis. Add that to a recent agreement with MLB to create a live weeknight show.

It’s worth noting former ESPN president, John Skipper is chairman of the DAZN Group. Though he’s reluctant to refer to the company as the “Netflix of Sports,” Skipper has shared that the streaming service has surpassed the announced million subscribers acquired by ESPN+.

Even though it initially focused on soccer in Europe, the company is mostly dependent on live boxing and MMA with more than 70 matches delivered through partnerships with Bellator MMA, and a billion-dollar, eight-year deal with promoter Eddie Hearn’s Matchroom Boxing.

A Canelo/Jacobs post-fight press release said more than 1.2 million viewers streamed the live fight telecast from T-Mobile Arena May 4. That figure included subscribers from the eight markets in which DAZN is available – the United States, Austria, Canada, Germany, Italy, Japan, Spain and Switzerland.

The star power in Matchroom’s stable of fighters is mostly aligned with world heavyweight champion Anthony Joshua, who fought in September ‘18 on the app, and will make his U.S. debut in Madison Square Garden under the DAZN banner.

Its parent company, Perform Group, is spending serious time at boxing cash register. It inked WBA and WBC middleweight world champion Canelo to a five-year, 11-fight deal that will pay the boxer at least $365 million. The partnership with the biggest draw in the sport is the highest paying athlete contract in sports history.

Early numbers indicated the Mexican middleweight’s presence on the app is important for the company’s bottom line. Alvarez’s inaugural fight on DAZN in December drove hundreds of thousands of people to sign up for the service, but just about half cancelled after their inaugural one-month free trial to pay the $9.99 monthly. It’s been reported more than 90 percent of customers who cancelled the service said another Alvarez fight is what would get them to pay.

DAZN is gobbling up boxing’s biggest names. Including Kazakhstani middleweight, Gennady Golovkin’s six-fight deal worth more than $100 million. Boxing fans are already hoping both Alvarez and “GGG” under the same banner creates a third match between the two rivals. Their first two fights had 2.4 million PPV buys that generated $200 million in revenue.

Jay Chaudhry, Co-founder of Break Media, and recipient of the 2019 Cynopsis Media Sports Award for Best Partnership in Sports, doesn’t mince words when it comes to the viability of DAZN verses the traditional means of championship boxing viewership, Pay Per View.

“It’s all about audience acquisition. DAZN is building a platform for the future from every angle. Do you have any idea how important it is for a fighter to understand WHO his viewer is? What good is a PPV draw when you can’t even prove or show the fan’s data?”

That data is the personal information including name, zip code and content consumed shared by subscribers. Marketing gold for promoters seeking to sell, sell, sell.

Chaudhry’s Break Media has a stake in the game as its core business is athlete marketing and reputation management, primarily through the digital landscape. “No matter how you cut and dice it, PPV will be a thing of the past. Every fighter outside of DAZN, and future apps alike will eventually have no choice but to hop on,” he added.

The company is playing with a ton of house money. It’s bankrolled by main investor Ukrainian-born Len Blavatnik, who has a net worth of $18 billion. Blavatnik built a fortune from oil and aluminum deals in Russia. Still, you have to wonder how long before profits will have to meet those lofty expectations.

*

Follow LVSportsBiz.com on Twitter, Facebook and Instagram.